The Government of Uganda has warned that disruptions in global export markets, escalating regional conflicts and worsening climate-related shocks pose significant risks to the implementation of its proposed Shs69.399 trillion national budget for the 2026/27 financial year.

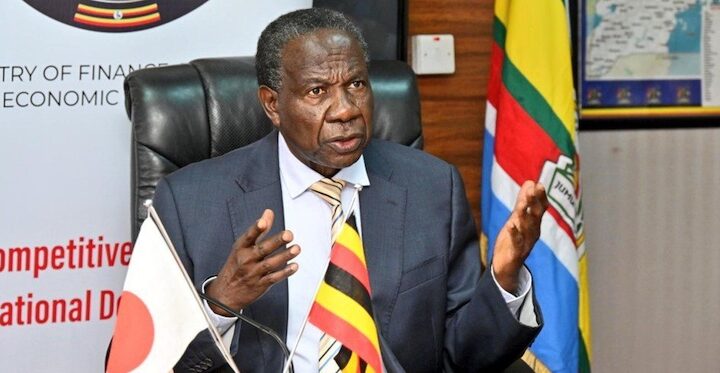

The concerns are detailed in the National Budget Framework Paper (NBFP) for FY2026/27, tabled before Parliament on December 16, 2025 by the State Minister for Finance (General Duties), Henry Musasizi, in line with the Public Finance Management Act (PFMA), 2015.

Under Section 9 of the PFMA, the NBFP outlines government’s medium-term fiscal strategy, key macroeconomic assumptions, budget priorities and fiscal risks, and provides the basis for annual budget preparation and debt sustainability.

In the framework, government identifies volatility in global trade as a major threat to revenue mobilisation and foreign exchange inflows. Minister Musasizi notes that changes in global trade patterns could reduce Uganda’s export earnings and weaken foreign currency inflows.

To mitigate this risk, government plans to prioritise export diversification, expand access to regional and continental markets, and improve the quality and quantity of export products, in line with commitments under the African Continental Free Trade Area (AfCFTA) and the East African Community framework.

The warning comes despite recent improvements in export performance. According to the Ministry of Finance’s Performance of the Economy Monthly Report for November 2025, Uganda’s merchandise exports increased by 55.9 percent to US$1.496 billion (about Shs5.4 trillion) in October 2025, up from US$959.9 million (Shs3.47 trillion) in September.

However, the report cautions that exports remain heavily concentrated in gold and coffee, leaving the economy exposed to price volatility and external shocks. Gold alone accounted for US$964.6 million of export earnings in October 2025.

The NBFP also highlights instability in global financial markets as a growing fiscal risk, particularly as Uganda continues to rely on external borrowing to finance infrastructure and development projects. Minister Musasizi warns that volatility in global financial conditions could raise borrowing costs and alter debt repayment obligations, potentially crowding out funding for priority sectors.

To cushion the economy, government plans to intensify domestic revenue mobilisation, fast-track innovative financing mechanisms and reduce dependence on costly external borrowing.

These risks are compounded by Uganda’s rising public debt, which stood at Shs119.4 trillion as of September 2025, according to Ministry of Finance data. Debt servicing continues to consume an increasing share of domestic revenues, narrowing fiscal space.

The framework further identifies regional insecurity, particularly in neighbouring countries, as a fiscal risk due to its potential to disrupt trade routes and trigger refugee inflows. Government notes that geopolitical tensions could distort expenditure plans and undermine export revenues.

Uganda hosts one of the largest refugee populations in Africa, and refugee-related spending has placed growing pressure on social services and public finances.

Domestically, the NBFP flags climate change as a critical threat to economic performance, especially agriculture, which employs more than 70 percent of Ugandans and contributes about 24 percent of GDP. Erratic rainfall, prolonged droughts and floods are cited as key factors undermining agricultural productivity and damaging infrastructure.

To address these challenges, government commits to strengthening climate adaptation policies and scaling up access to climate finance, including green bonds and debt-for-nature swaps, in line with the National Climate Change Act, 2021 and the Paris Agreement.

Despite the risks, government remains optimistic about the medium-term outlook. The NBFP aligns the FY2026/27 budget with Vision 2040 and the Fourth National Development Plan (NDP IV), which aims to transform Uganda into a middle-income economy through industrialization and commercialisation.

The framework projects that the size of the economy will grow from about US$60 billion to US$500 billion by 2040, under the government’s Tenfold Growth Strategy, which targets doubling GDP every five years. Economic growth is projected to reach up to 10.4 percent by the end of FY2026/27, partly driven by the anticipated start of oil production.

To support this growth path, government will prioritise investment in key enablers, including security, transport infrastructure, electricity, irrigation, education, health, water, industrial parks, domestic revenue mobilisation, regional integration, environmental protection, disaster management and anti-corruption efforts.

Implementation will focus on four strategic growth drivers: agro-industrialisation; tourism development; mineral-based industrialisation, including oil and gas; and science, technology and innovation, encompassing ICT and the creative industry.

Minister Musasizi described the NBFP as a critical anchor for Uganda’s economic transformation, saying it lays the foundation for higher household incomes, job creation and full monetisation of the economy.

Analysts caution, however, that achieving these ambitions will depend on government’s ability to manage fiscal risks, improve project execution and strengthen efficiency across public institutions amid an increasingly challenging global environment.

The Source Reports.

We come to you.

Want to send us a story or have an opinion to share? Send an email to [email protected] or WhatsApp on +256742996036.