Summary:

- However, when Ibrahim Ssemujju, the Member of Parliament for Kira Municipality, demand details on the ownership of some of these companies specifically J2E Investment Corporation, which has a tax obligation of Shs2.718 billion and close ties to the Army the Minister admitted that he was unaware of the individuals behind the company.

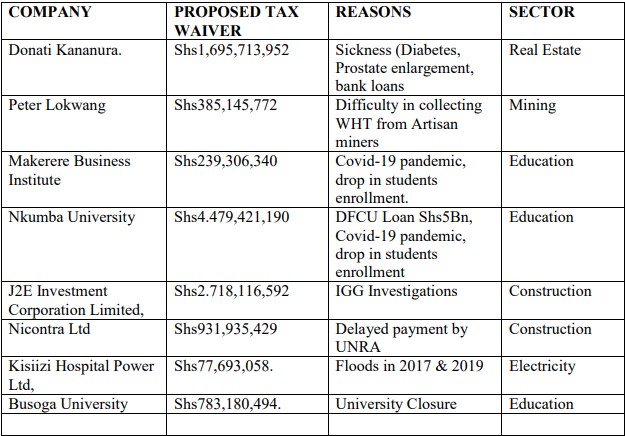

KAMPALA: Government of Uganda has requested Parliament to exempt eight companies and individuals from paying taxes amounting to Shs13.391 billion.

The reasons cited for this exemption include the adverse effects of the COVID-19 pandemic on their businesses and ill health. This request comes despite a recent report indicating that Uganda has lost over Shs12 trillion in the past five years due to similar tax waivers.

Henry Musasizi, the Minister of State for Finance, named the beneficiaries of the proposed tax waivers: Nkumba University, J2E Investment Corporation Limited, Nicontra Ltd, Kisiizi Hospital Power Ltd, Busoga University, Makerere Business Institute, Peter Lokwang, and businessman Donati Kananura.

However, when Ibrahim Ssemujju, the Member of Parliament for Kira Municipality, demanded details on the ownership of some of these companies specifically J2E Investment Corporation, which has a tax obligation of Shs2.718 billion and close ties to the Army the Minister admitted that he was unaware of the individuals behind the company.

Ssemujju also questioned the rationale for waiving businessman Donati Kananura’s tax obligation of Shs3.776 billion due to ill health.

“They said that J2E Investment Corporation Ltd is constructing barracks for the Army in Kaweweta, but because the government delayed in paying them, it now wants taxpayers to cover the company’s taxes due to its interests. What is surprising is that the UPDF [Uganda People’s Defence Force] has contracts in the construction industry, building stadia and roads, but when it comes to constructing Army barracks, there is only one company doing that job,” Ssemujju remarked.

“When we asked who owns J2E Investment Corporation Ltd, they wouldn’t say. When we asked when the company started, they wouldn’t reveal this information. How is it possible that this company, which started as a construction company, only focuses on Army construction? And the Minister says he doesn’t know the owner of this company? Why is it that this is the only company receiving Army contracts? The Minister failed to explain,” Ssemujju added.

MPs also questioned the criteria used to grant these tax waivers. In response, Minister Musasizi explained that any taxpayer who feels entitled to a waiver must submit a request to the Commissioner General of the Uganda Revenue Authority. Section 40(1) of the Tax Procedures Code Act grants the Commissioner General the authority to recommend taxpayers for waivers.

“If the Commissioner is of the opinion that the whole or any part of the tax payable by the taxpayer cannot be effectively recovered due to hardship, impossibility, or excessive cost of recovery, they may refer the taxpayer’s case to the Minister. When the Minister receives the case, the law requires that we submit it to Parliament, and it is on this basis that I have submitted the request,” Minister Musasizi explained.

The Source Reports.

We come to you.

Want to send us a story or have an opinion to share? Send an email to [email protected] or WhatsApp on +256742996036.